The U.S. and China are locked in a battle over technology, which went public over Singapore-based Broadcom’s hostile bid to buy the U.S.-based Qualcomm. Should Broadcom succeed, it will make that company a major influence in computer chip development. But a U.S. Treasury official, in calling for a review of the deal, wrote that, “China would likely compete robustly to fill any void left by Qualcomm.” Under president Xi Jinping, China has made no secret of its plan to dominate tech industries including artificial intelligence and supercomputers.

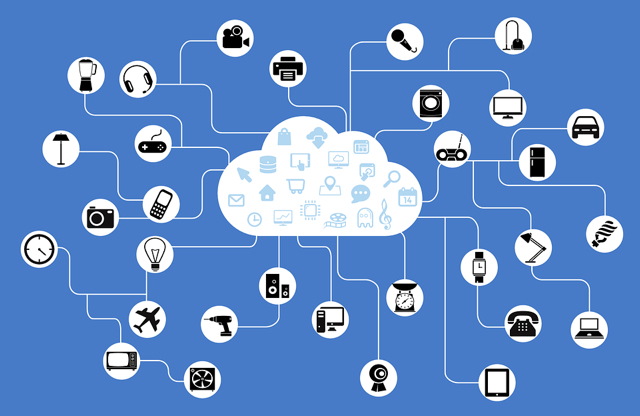

The New York Times reports that China’s “aggressive push has set off alarms in Washington, with policymakers and lawmakers fearful that American giants could lose their edge.” Qualcomm is “a leading player” in the evolution to 5G high-speed networks, which will power the Internet of Things, autonomous vehicles and other new technologies.

“Having a well-known and trusted company hold the dominant role that Qualcomm does in the telecommunications infrastructure provides significant confidence in the integrity of such infrastructure as it relates to national security,” wrote the same Treasury official. Last year, explains NYT, “the White House blocked a Chinese-backed investor from buying Lattice Semiconductor, which is a supplier to the United States government.”

“This is about China’s efforts to invest and acquire key parts of the U.S. innovation system,” said UC San Diego’s Institute on Global Conflict and Cooperation director Tai Ming Cheung. The Committee on Foreign Investment in the U.S. (CFIUS) may gain in strength, with new bipartisan legislation to broaden its jurisdiction making its way through Congress.

The bill “would give CFIUS the authority to assess some types of joint ventures, minority investments and real estate transactions near military bases,” and “widen the definition of ‘critical technologies’ slated for potential review to include emerging technologies that could be essential for maintaining the U.S. technological advantage over countries that pose threats, such as China.”

The U.S. Trade Representative is also investigating whether China is “harming American intellectual property rights, innovation or technology development,” in exchange for access to the Chinese market. This puts technology companies in the middle, as they want such access to the world’s second largest economy.

Elsewhere, NYT reports that the effort to develop 5G has “brought many new players to the fore, including Huawei,” a Chinese company “largely blackballed from the United States on national security grounds.” CFIUS reports that Huawei owns an estimated 10 percent of the patents “essential for 5G networks.” Huawei, which has been working on 5G since 2009, already spent $600 million on research and has committed $800 million more for 2018.

Other major contributors to 5G include Sweden’s Ericsson, South Korea’s Samsung Electronics, Finland’s Nokia and several companies in Japan. Intel is also increasing its efforts to contribute.

At the recent Mobile World Congress, Huawei “demonstrated the first cellular base station that complies with the new 3GPP specifications,” but others noted that, “it was hard to top Qualcomm’s presence,” because the company has “a string of technologies that it has shaped for 5G.”

No Comments Yet

You can be the first to comment!

Sorry, comments for this entry are closed at this time.